Did you know that Anacortes with a population of approximately 16,189 as of 2015 and 18,270 as of 2025, has seen sharp increases in property taxes, utility fees and cost of building homes from 2015 to 2025? We have discussed property taxes in previous blogs. This blog will focus on utilities fees and cost of building homes.

I Trends in Fees

I-1 Electricity Rates

Electricity rates in Anacortes have consistently exceeded state averages. According to Electricity Local, the average residential electricity rate in Anacortes is 10.36¢/kWh, 21.45% higher than Washington’s average of 8.53¢/kWh. For the past 25 years, Washington’s electricity prices have risen at an annual rate of 4.27%, outpacing the average inflation rate of 3.35% from 1998 to 2022. Puget Sound Energy proposed rate increases, including a 12.9% hike in 2023, though the Washington Utilities and Transportation Commission approved an 8.7% increase. This reflects a broader trend of rising energy costs driven by state policies and infrastructure needs.

I-2 Water, Sewer and Storm Water Rates

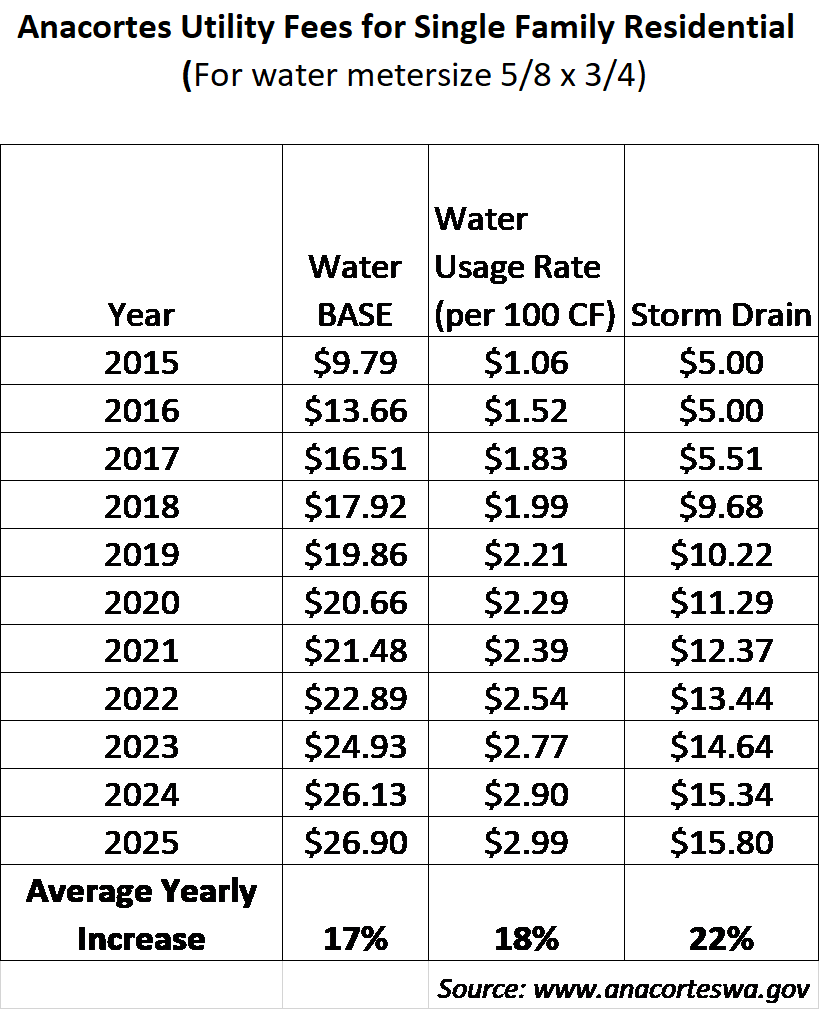

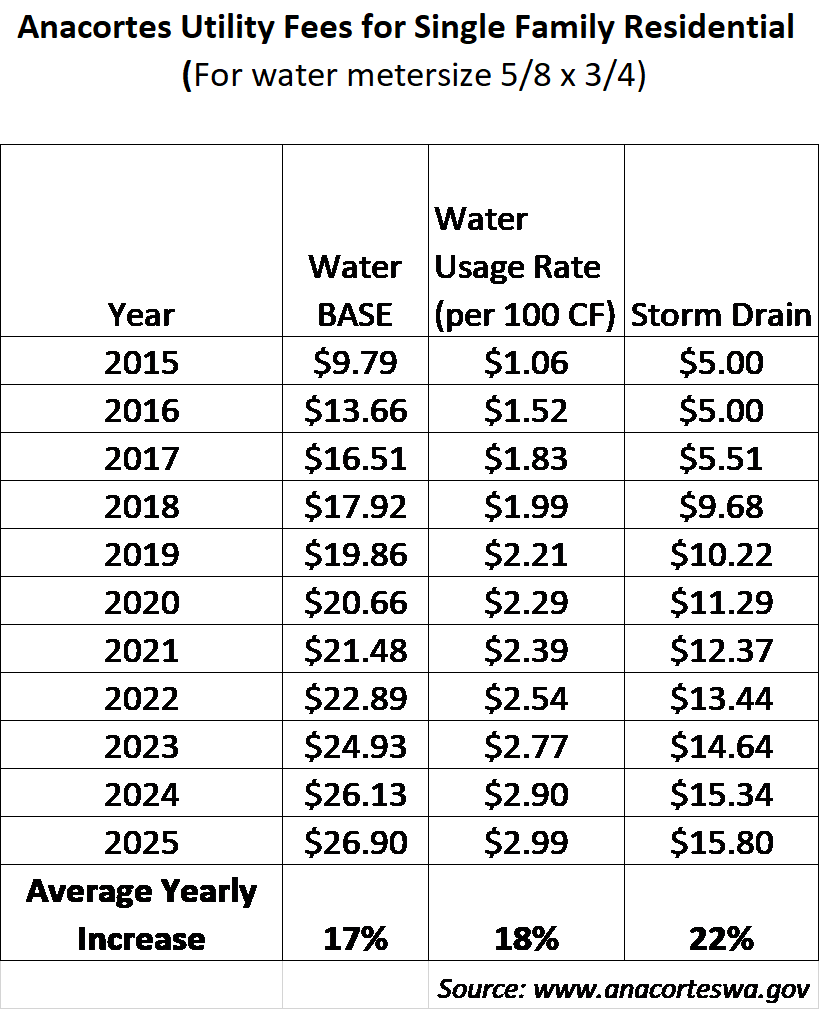

Water and sewer rates in Anacortes are managed by the city and not regulated by the UTC. A 2015 Anacortes Retail Water Rate Study emphasized the need for rate adjustments to fund infrastructure maintenance. In 2019, the City Council approved a $3,823 increase in the general facilities charge (GFC) for water and sewer connections for new construction to fund a new water treatment plant and wastewater treatment plant expansion. Contractors and residents have felt the higher GFC impact on their costs to build new homes. Some even came to the City Council meetings to complain about the high cost to hook up to city utilities.

In the past ten years, water rates and storm water fee for single family residents have increased almost 20% annually. Concerned citizens have spoken at the Monday night city council meetings and requested the City Council to help with high water bills. The sewer rates have an average of 5-7% increase annually which is also higher than the average inflation rate.

I-3 Solid Waste and Other Utilities

Solid waste services, including garbage, recycling, and organics, cost approximately $30 per month in Anacortes in 2025, aligning with state averages due to participation in recycling and composting programs. The city imposes a 12% solid waste utility tax, with an additional 3.6% state public utility tax forwarded to Washington. Natural gas prices have also risen, with residential rates increasing 16% from 19.02 $/Mcf in September 2023 to 21.98 $/Mcf in September 2024.

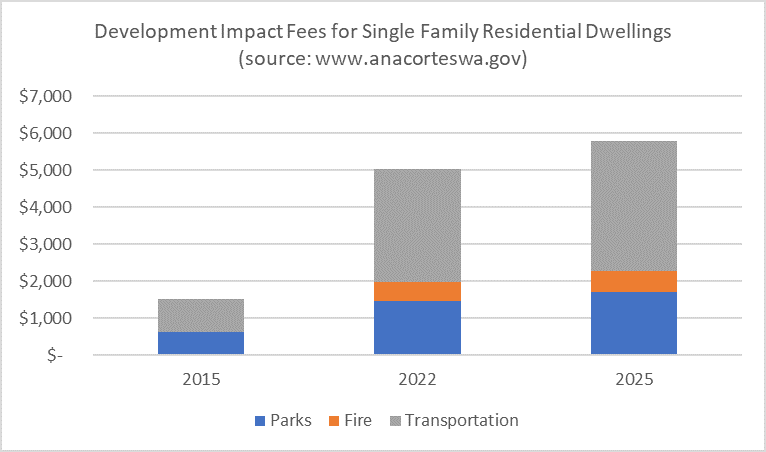

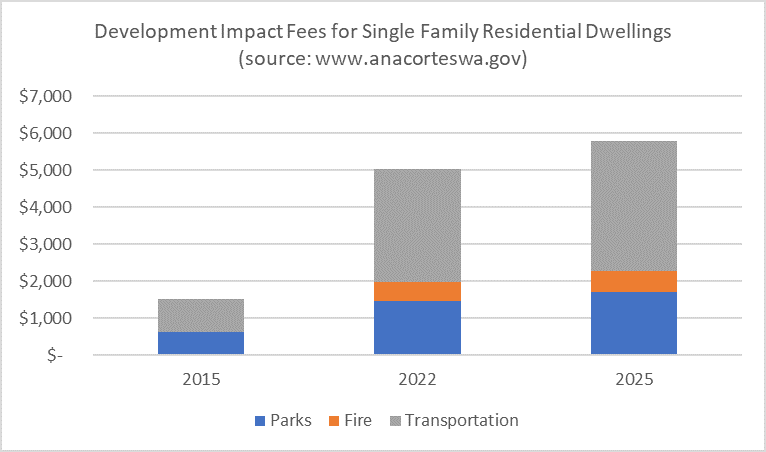

I-4 Development Impact Fees

In 2021, Anacortes raised residential development impact fees for parks, increasing them from $616 to $1,362 for single-family homes and setting them at $981 per multifamily unit. The city also significantly increased transportation impact fees. These adjustments were based on the city’s Comprehensive Plan, which projects a population growth of 5,000 and a need for 3,000 additional housing units. Additionally, a new commercial development impact fee was introduced to support $4 million in park-related capital projects. These increased fees have contributed to higher building costs, home prices, and overall living expenses, exacerbating the demand for affordable housing. This, in turn, necessitates additional taxes and fees to fund affordable housing initiatives, creating a concerning cycle of rising costs and financial burdens.

II Impact on Residents

Rising utility fees exacerbate Anacortes’ high cost of living, 19% above the Washington average and 40% above the national average. Low-income and fixed income households face particular challenges. Recognizing the financial strain on residents, Anacortes offers a Utility Discount Program providing a 30% reduction on utility bills for eligible low-income households. Eligibility is based on income guidelines and property tax exemptions. A $2 discount for Auto Pay and Paperless Billing is also available but require enrollment.

III Conclusion

Building and cost of living in Anacortes have risen sharply from 2015 to 2025 due to infrastructure upgrades and expansion, operational cost increases, state energy policies, population growth and inflation. Energy cost has grown steadily while city utility fees saw significant increases. To address affordability, Anacortes should examine its capital facilities plan against its actual population growth. For the past ten years, the city has an average of 1.3% annual population growth, much lower than its Comprehensive Plan’s growth factor which is the basis for capital projects, policy development and city planning. Building infrastructure capacity ahead of population growth curve significantly burdens its current residents. Additionally, the city should invest in energy-efficient infrastructure to balance service reliability with resident needs. While these increases are essential for maintaining and enhancing service quality, they underscore the importance of transparent budgeting and financial assistance programs to support residents.

Sal Walker

Anacortes, WA