Did you know Anacortes School District is asking voters to approve significantly larger levies in February 2026? When Anacortes residents open their property tax bills, it can be challenging to determine who actually receives those dollars. The City of Anacortes 2026 Final Budget document offers a clear snapshot on page 33 that helps answer this question. It also underscores why school district levies and bonds warrant close scrutiny in the coming years.

The Big Picture: Property Taxes in Anacortes

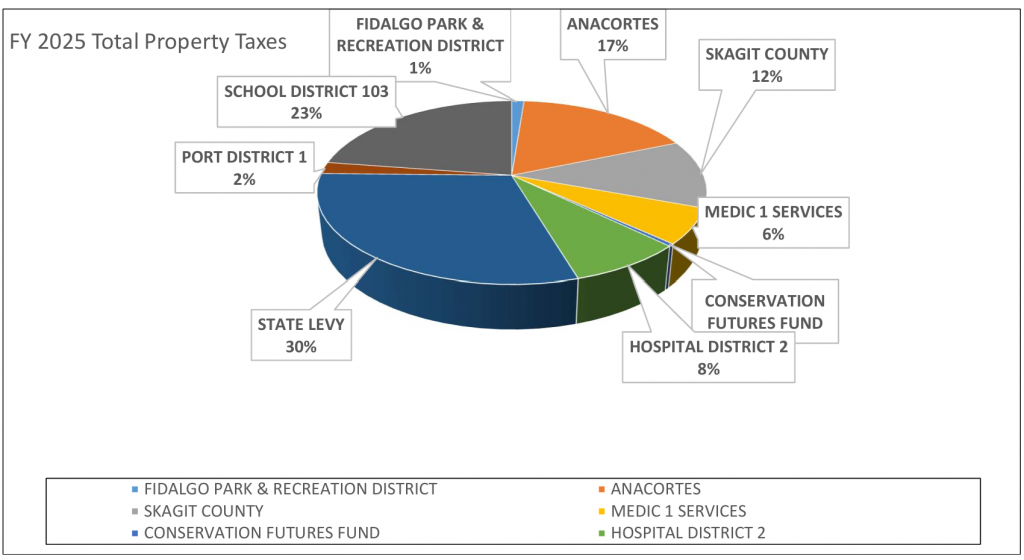

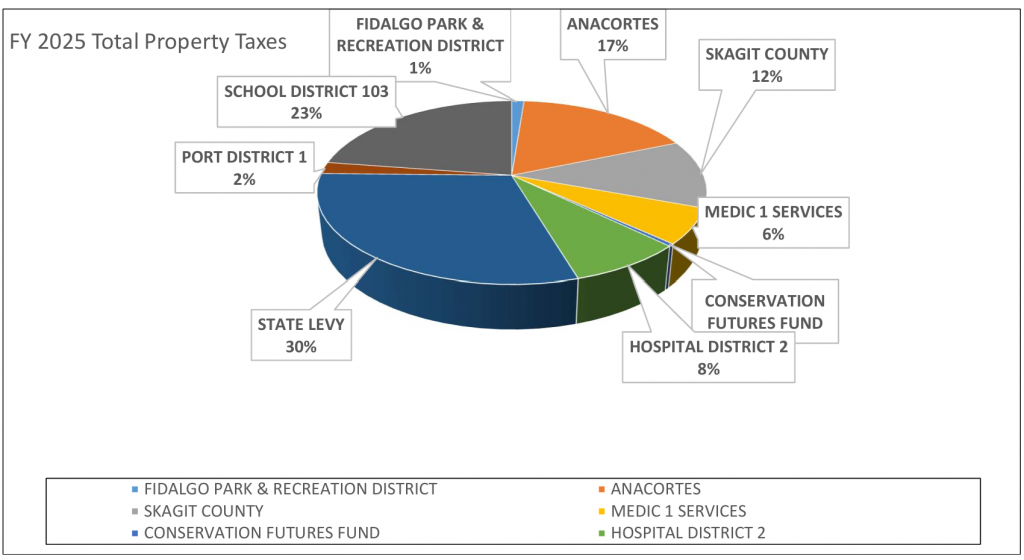

According to the city’s full-year 2025 property tax breakdown, nearly one-quarter of every property tax dollar paid by Anacortes residents goes to the Anacortes School District. Here’s how the total property tax pie is divided:

Full Year 2025 Anacortes Property Tax Breakdown

The school district receives a larger share of local property taxes than the city itself, second only to the State. As new school levies appear on upcoming ballots, understanding how they fit into the overall tax picture is essential.

Anacortes School District Budget and Funding Sources

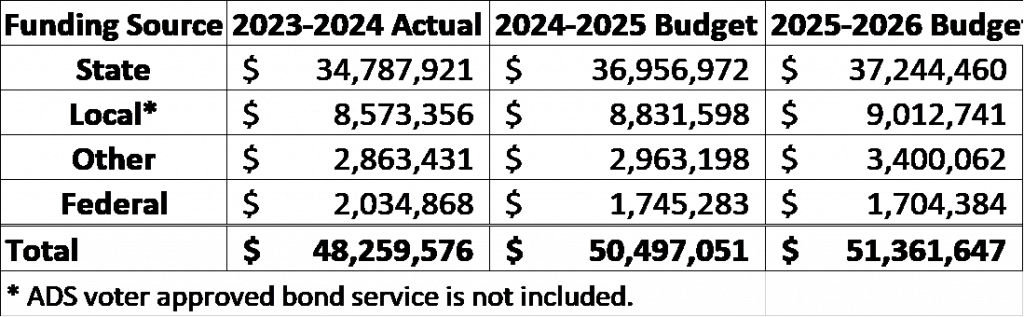

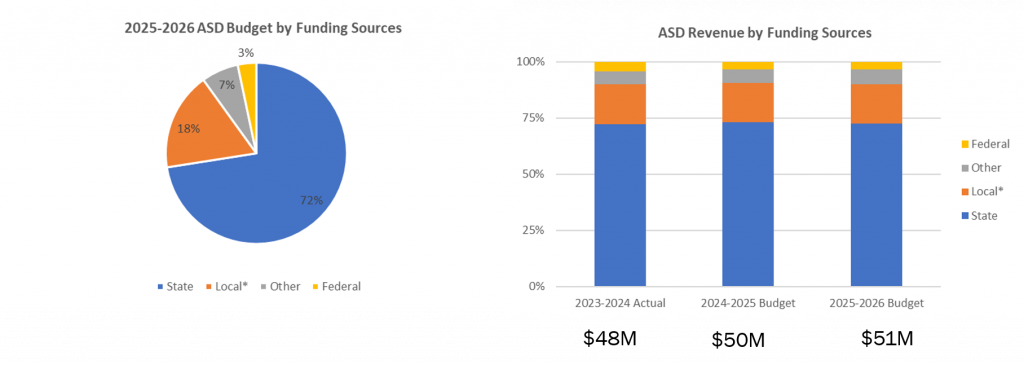

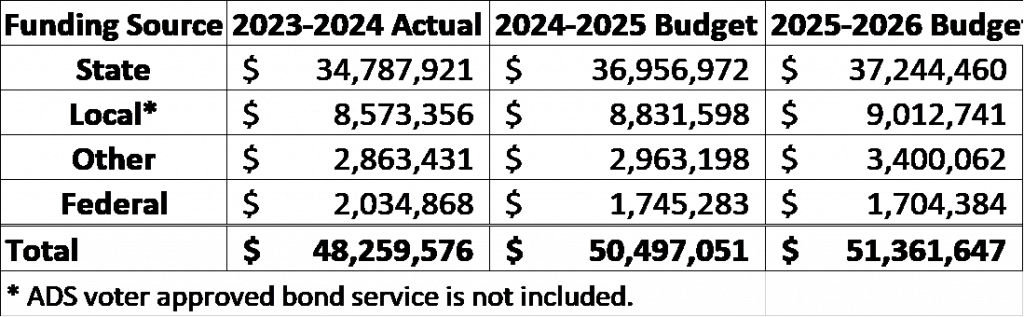

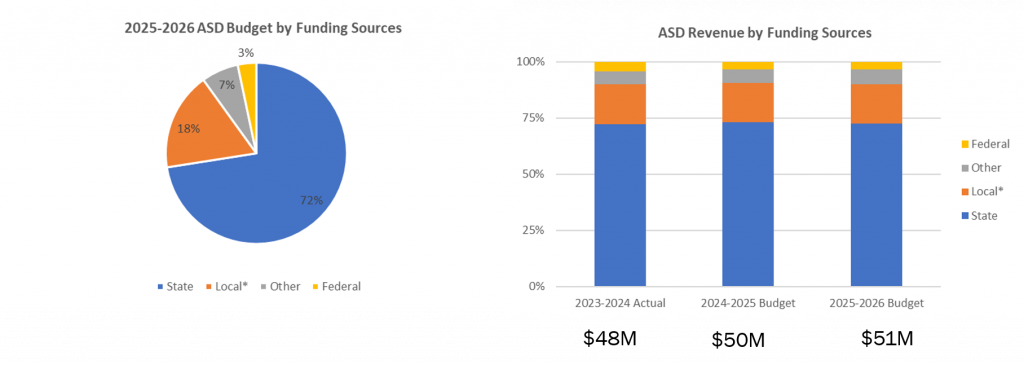

According to https://www.OSPI.k12.wa.us, ASD is funded by Washington state, Local taxes, Federal government and other sources. The proportions from the four major sources have been stable for the past three years as shown in Table 1 and the charts below. The state funding actually increased by 3% annually for the past three school years despite declining enrollment of 1%.

Table 1. ASD Revenue by Funding Sources

What Makes School Taxes Different?

Unlike the State levy or the City’s regular levy (which is capped at a 1% annual increase), school taxes are driven by voter-approved levies and bonds.

- Educational Programs & Operations (EP&O) Levies fund day-to-day school operations such as staffing, programs, and services not fully covered by state funding.

- Technology and Capital Improvement Levies fund instructional technology upgrades and facility maintenance.

- Capital Bonds fund long-term construction, major renovations, and facility upgrades, with repayment stretching over decades.

These measures are layered on top of the existing school tax base and significantly change a household’s tax bill.

Looking Ahead: Proposed ASD School Levies and Bond Service

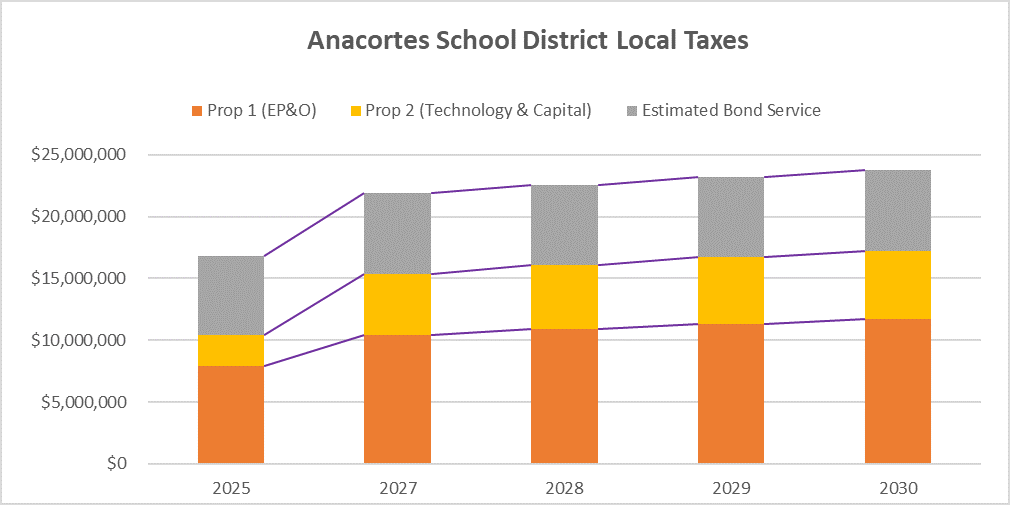

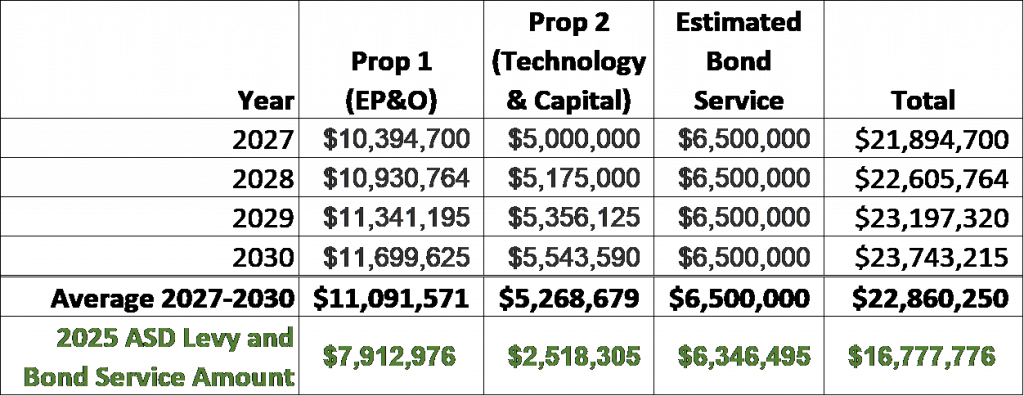

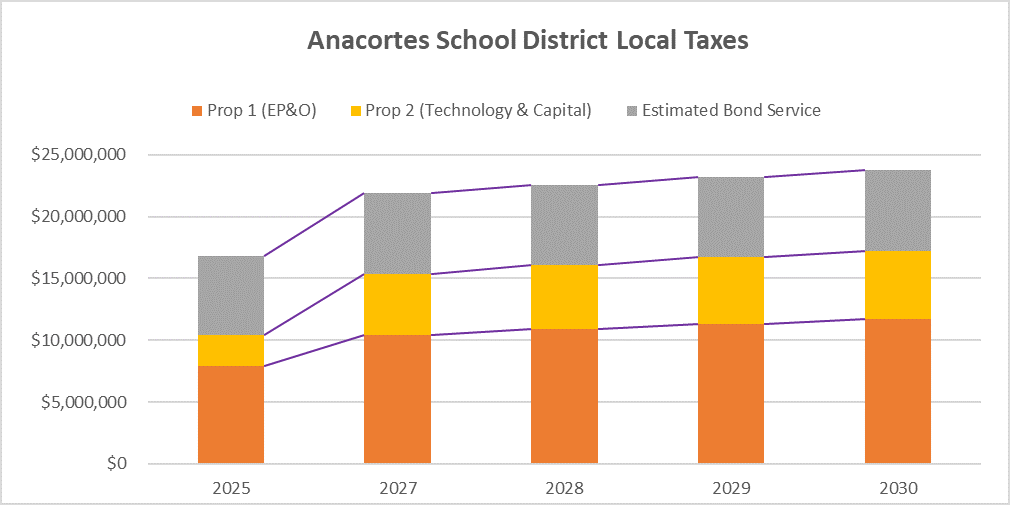

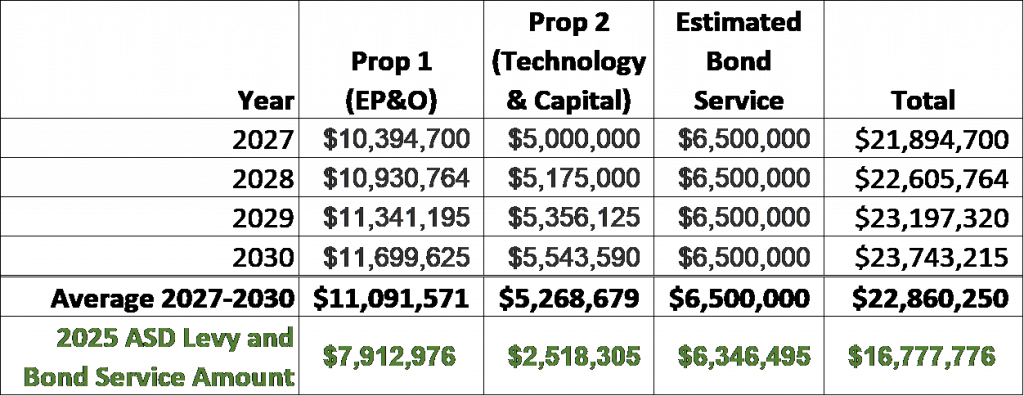

The Anacortes School District (ASD) levies (see Table 2) shows that school levy collections are set to increase in the coming years if Proposition 1 and 2 pass in February 2026, even as enrollment trends remain flat or declining. When levies are reset, they often establish a higher dollar amount, permanently elevating the baseline for future collections. The bond service figures in Table 1 are an estimated average from 2026 to 2035 based on the school bond terms.

The proposed levy increase will not be implemented until 2027 if Proposition 1 & 2 are approved by the voters. To visualize the projected growth in total school taxes (including levies and bond service), the stacked column chart shows the totals for 2025 and the projected years 2027–2030. This represents an average increase of about 36% from the 2025 total to the 2027-2030 average.

Table 2. ASD Proposed Levies and Estimated Bond Services 2027-2030

What Residents Should Ask Before Voting

Given the substantial share of property taxes allocated to the school district, residents should feel comfortable asking clear, practical questions before approving new measures:

- How does projected spending align with enrollment trends?

- What maintenance was deferred in the past, and why?

- What portion of costs should be funded with bonds versus operating levies?

- How much will the school tax cost your household over time?

Transparency matters — especially when schools already account for one dollar out of every four paid in property taxes. An informed vote starts with seeing the full pie, not just one slice of it.

Sal Walker

Anacortes, WA